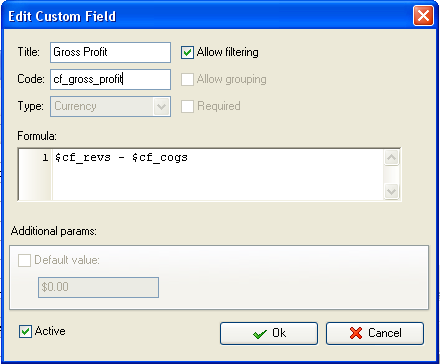

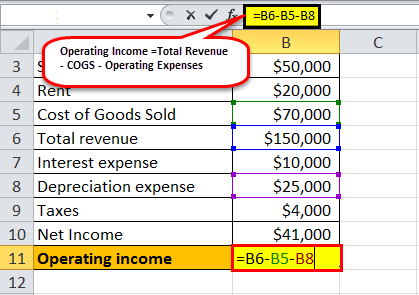

The beauty behind the financial statements of a company is that they are all linked and tie back to one another. Income statements show how profitable your company is, with profits and losses recorded over a given period-while the other two main financial statements (balance sheets and cash flow statements) serve different purposes. If you’d like to review the figures that determined your net income, simply read the income statement from top to bottom. Net income: Revenue minus all other expenses such as the cost of goods sold, taxes, admin expenses, and operating costs.Ī business’s net income is recorded in the income statement and is typically seen on the bottom line.For example, materials and utilities are part of COGS. Cost of goods sold (COGS) is how much it costs to maintain production or perform a service. Gross profit: Revenue minus the cost of goods sold.Both gross income and net income can measure profitability, but net income provides the clearest picture. Gross profit and net income should not be used interchangeably. In the first quarter, your bakery had a net income of $32,000. Now you can plug both numbers into the net income formula: Next, you’ll need to calculate your total expenses, including the cost of goods sold, rent, utilities, general expenses, operating expenses, payroll, interest, and taxes. Looking at these numbers, you have your total revenue on hand ($75,000). You crunch some numbers and create the following line items on your income statement: Let’s say you run a small bakery and want to find your net income for the first quarter of the year. This percentage will show you how much money you bring in from each dollar of revenue. With net income, you can also calculate the net profit margin by dividing your net income by revenue and multiplying it by 100 to get a percentage. Your total expenses will include every cost you’re responsible for, including taxes, interest, debt, deductions, operating expenses, and general expenses.Total revenue can also be referred to as gross income, which is your revenue minus your cost of goods sold.When using the net income formula, it’s important to remember what total revenue and total expenses include: Determine how much you earn before taxes: Subtract your business expenses, taxes, and operating costs from your gross income.Find your total revenue, or gross income: Revenue minus cost of goods sold.Net income = total revenue – total expenses

To calculate net income, you’ll use the following formula:

0 kommentar(er)

0 kommentar(er)