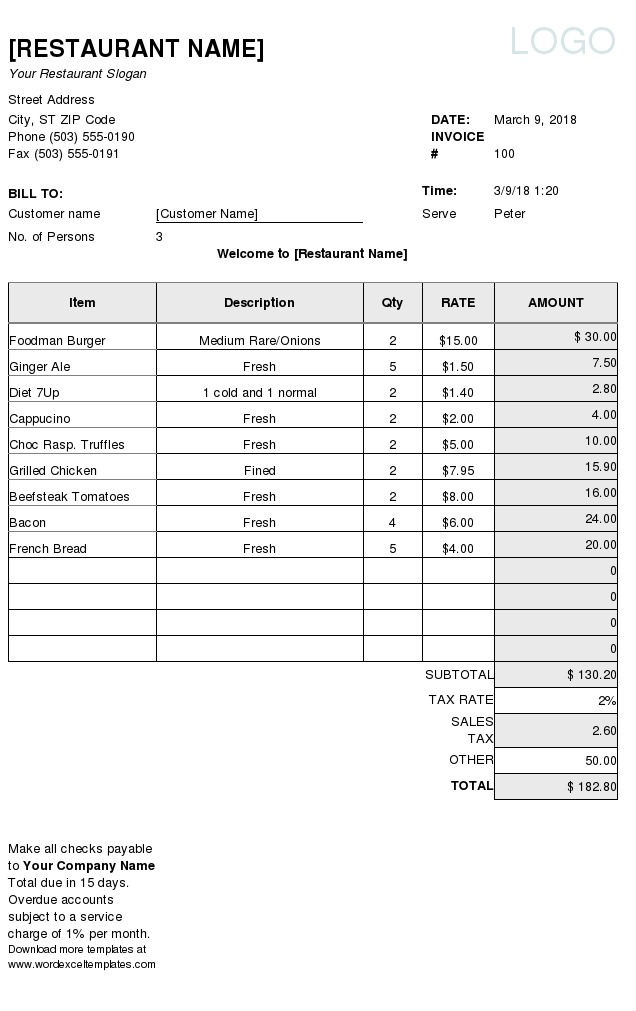

The date of when the receipt has been generated.The signature of the customer or client.The signature of the cashier or the receiver of the payment.The method of payment (either cash, check, or credit card).The amount of the value added tax or the tax rate.The subtotal amount of all purchased products and availed services.The sum or the total amount to be paid for each product or service.

The fixed price for each service availed.The number of times availed the particular service/s.The title or the name of the service availed or provided.Hence, refer to the following details below to know what a receipt form for those businesses that offer products and services at the same time contains: The type could either be about selling or vending some items or providing efficient services to the clients. Receipts differ depending on the type of business. The list above is basically the details or the information that you usually see on a generic receipt form. The name, signature, and date signed by the cashier (or the payment recipient).The amount of tax collected from the purchased products.The list of all items purchased (the reason or purpose of the payment).The date of when the receipt is generated or printed.The payment received from (or the name of the customer).Generally, a receipt form often contains the following: In addition, by means of keeping the receipt for a while, the individual will be able to conduct an efficient allocation of their budget at home and at work, thus, keeping them aware of how much they have spent and updated with regards to how much is left in their individual budget. The receipt forms are not only applicable or useful in businesses, these could also help the individual track the daily, weekly, monthly, and even their annual personal expense reports. These receipts serve as the confirmation of the customers or clients with regards to their purchased products.These forms of receipt also serve as an evidence that the taxes were collected from the sold products or items.The receipt forms are used to prove that there was a transaction made.With the use of receipt forms, the finance or accounting manager will be able to track the profit and loss statements of the business or the company.Therefore, the receipts serve as a guide or a reference for the individual.įurther purposes of receipt forms are as follows: This is in order for the customers, clients, or consumers to be aware of what particular items or services they have paid for. The receipt form usually consists of the list of items or products and the services that were either purchased or availed. This acknowledgment slip is referred to as a receipt that is used as a written proof that a product or a service has been received in exchange for an amount of cash.

0 kommentar(er)

0 kommentar(er)